- Alpha Catalyst

- Posts

- DarioHealth Stock Sparks a Recovery as Digital Health Market Momentum Accelerates

DarioHealth Stock Sparks a Recovery as Digital Health Market Momentum Accelerates

DarioHealth may be seeing the start of a recovery, as new capital flows into the digital health space and wall street analysts point to significant potential upside

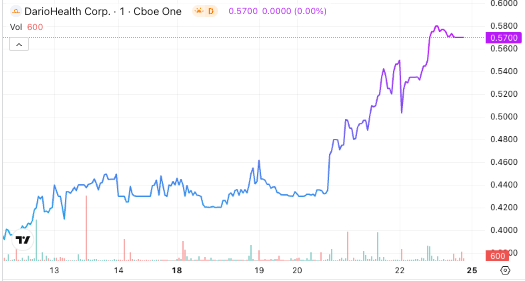

DarioHealth Corp. (NASDAQ: DRIO) shares have been recovering momentum since August 20th, 2025, climbing over 30% in just three trading days as investors begin to recognize the massive valuation disconnect between the digital health pioneer and its rapidly expanding sector. The stock recovered from $0.432 on August 20th to $0.57 by August 22nd, building on analyst optimism following the company's August 13th earnings report where it beat consensus GAAP estimates despite lower revenue while maintaining what analysts describe as an "attractive valuation."

The timing of DRIO's resurgence coincides with a broader wave of optimism sweeping through the digital health sector, driven by substantial new investments, strategic acquisitions, and increasingly bullish market forecasts that position the industry for explosive growth over the next decade.

Dario Health Stock’s Recovery (TradingView)

Digital Health Market Reaches Inflection Point

The catalyst for renewed investor interest appears rooted in fundamental shifts occurring throughout the digital health ecosystem. According to a comprehensive market analysis released by SkyQuest, the global digital health market is projected to reach $449.19 billion by 2032, representing a robust compound annual growth rate of 10.8% from the current valuation of $197.75 billion in 2024.

This growth trajectory seems to reflect the increasing prevalence of chronic diseases worldwide, driving demand for remote monitoring and telehealth solutions that provide continuous patient care while reducing costly hospital visits. The market expansion is further accelerated by advancing mobile technology and widespread smartphone penetration, creating unprecedented opportunities for innovative health solutions across both developed and emerging markets.

Government initiatives promoting digital healthcare infrastructure and regulatory support have emerged as crucial growth catalysts. Many countries are implementing comprehensive e-health policies, expanding telemedicine reimbursement frameworks, and strengthening data privacy regulations to facilitate widespread adoption of digital health technologies.

Investment Capital Floods Digital Health Sector

The sector's investment momentum reached new heights this week with Twin Health's announcement of a $53 million Series E funding round on August 21st, led by Denmark's Maj Invest. The investment, which values the AI digital twin pioneer at approximately $950 million, underscores the growing appetite among institutional investors for proven digital health platforms capable of delivering measurable clinical outcomes.

Twin Health's funding success is particularly significant given its focus on metabolic health management, an area closely aligned with DarioHealth's core competencies in diabetes care and chronic condition management. The company's recent study results, published in the New England Journal of Medicine Catalyst, demonstrated that 71% of participants using its AI digital twin platform achieved diabetes remission while reducing medication dependence.

These results highlight the sector's shift toward evidence-based digital therapeutics that can demonstrate clear return on investment for healthcare payers and employers seeking to control rising medical costs while improving patient outcomes.

Strategic Consolidation Reshapes Competitive Landscape

The digital health sector is simultaneously experiencing significant consolidation activity, with strategic acquirers seeking to capture market share and expand capabilities through targeted acquisitions. Stockholm-based Mindler's recent acquisition of Cambridge-based ieso Digital Health UK exemplifies this trend, bringing together two clinically advanced platforms to create what the company describes as Europe's most comprehensive digital mental health offering.

This consolidation activity creates both opportunities and challenges for independent players like DarioHealth, which must compete for market position while navigating an increasingly complex competitive environment populated by well-capitalized strategic buyers and private equity-backed consolidators.

Analyst Optimism Meets Market Reality

Despite DRIO's recent price recovery, the stock continues to trade at substantial discounts to sector peers and analyst price targets. Following the company's second quarter results on August 12th, Litchfield Hills Research maintained its buy rating on August 13th, noting that DRIO beat consensus GAAP estimates on lower revenue while retaining what the firm characterized as an "attractive valuation." The company reported an earnings per share loss of $0.18, significantly better than the consensus estimate of a $0.23 loss, even as revenue came in below expectations.

Research from Litchfield Hills Research maintains a buy rating with a $2.00 price target, representing potential upside of approximately 250% from current trading levels around $0.57. The analyst coverage highlights DRIO's attractive fundamental metrics, including approximately 80% gross margins in its core business-to-business-to-consumer segment and a strategic transition toward higher-quality recurring revenue streams. The company has signed 21 new clients year-to-date and expects to reach 40 new client additions by year-end, demonstrating continued commercial traction despite near-term revenue headwinds.

Comparative valuation analysis reveals DRIO trading at approximately 0.4 times projected 2026 sales, representing an 81% discount to peer group averages. This valuation gap appears particularly compelling given the company's established market position, proven clinical outcomes, and pathway toward profitability expected in late 2026.

Market Fundamentals Backing a Recovery

The convergence of favorable market dynamics, increased investment capital, and strategic consolidation activity creates a supportive environment for DRIO's continued recovery. The company's focus on chronic disease management aligns directly with healthcare industry priorities to reduce costs while improving patient outcomes through technology-enabled care delivery.

As healthcare costs continue rising and skilled medical professional shortages persist, digital health solutions like those offered by DarioHealth become increasingly essential for optimizing resource utilization and expanding healthcare access. The pressure to improve efficiency while controlling costs accelerates adoption of digital health technologies across both public and private healthcare systems.

For investors willing to accept the inherent volatility of small-cap digital health stocks, DRIO's recent recovery may represent the beginning of a broader revaluation process as market participants recognize the disconnect between the company's current valuation and the rapidly expanding opportunity set within the global digital health market.

Recent News Highlights from DarioHealth:

Legal Disclaimers, Terms & Disclosures:

By using AlphaCatalyst, any related brands thereof, and any affiliated or partner websites operated under the Wall Street Wire Network (collectively referred to as “Services”), you acknowledge that any and all Services provided are for informational and entertainment purposes only and do not constitute a recommendation for any particular stock, company, investment, commodity, security, transaction, or any other method of trading featured anywhere on AlphaCatalyst or affiliated platforms. AlphaCatalyst does not guarantee the accuracy, completeness, or timeliness of the information or Services provided. Views and opinions presented through the Services, whether expressed by contributors, columnists, external partners, or employees, are not specifically endorsed by AlphaCatalyst or the Wall Street Wire Network, and neither entity accepts responsibility or liability for any actions, financial or otherwise, taken directly or indirectly as a result of engaging with any of the Services offered.

AlphaCatalyst, its employees, operator, partners, affiliates, and any other representatives will not, either directly or indirectly, be held liable, accountable, or responsible in any capacity to you or to any third party for any errors, inaccuracies, or omissions from the Services, including but not limited to market quotes, rumors, unverified chatter, financial data, and news reports; for any interruptions, delays, or transmission errors affecting the availability or accuracy of the Services; or for any damages or losses arising from or related to the use of, reliance on, or inability to access the Services. Some content published by AlphaCatalyst may reference market rumors, speculative chatter, or unconfirmed reports. Readers should be aware that while such unofficial information may be associated with market volatility, price movements based on speculative or incomplete data are subject to change rapidly upon further clarification or the release of official news or filings.

AlphaCatalyst reserves the right at any time to modify any part of its Terms of Service or any portion of the Services, including but not limited to the removal or addition of content, features, contributors, or affiliated content providers, or the introduction of any associated fees or usage conditions. Such changes will take effect immediately upon their publication across the Services and will apply to all users from the time of posting. Please note that trading in foreign currencies, stocks, options, and other securities involves substantial risk and may result in significant financial losses. Neither AlphaCatalyst nor its staff recommends that you buy, sell, or hold any security, and no part of the Services constitutes personalized investment advice. All information provided through the Services is general commentary intended for informational and entertainment use only. AlphaCatalyst disclaims any liability for loss or damage, including without limitation any loss of capital, profit, or opportunity, that may arise directly or indirectly from use of or reliance on the information contained within the Services. We encourage all users to conduct their own due diligence and consult with a certified financial advisor or licensed professional before making any financial decisions.

Content produced by or for AlphaCatalyst may not be reproduced, republished in full, or redistributed in any form without prior written permission from AlphaCatalyst or the Wall Street Wire Network, as applicable.

This content is a form of paid promotional content and advertising. Wall Street Wire has received cash compensation from DarioHealth Corp for promotional media services provided on an ongoing subscription basis. This content is for informational purposes only and does not constitute financial advice. Wall Street Wire is not a broker-dealer or investment adviser. Full compensation details and information regarding the operator of Wall Street Wire are available wallstwire.ai/disclosures.

We are not responsible for any price targets or market size figures that may be cited in this article nor do we endorse them, they are quoted based on publicly available news reports and additional price targets or figures may exist that may not have been quoted. Readers are advised to refer to the full reports mentioned on various systems and the disclaimers/disclosures they may be subject to. This article was not reviewed or approved by the issuer prior to publication and should not be considered an official communication by the issuer.